Learn how to use the software to prepare your tax return. It is worth it.

If you can open a small business, freelance to earn income, or work as an Independent Contractor, you can learn to prepare and submit your tax return. No certification or license is needed to submit a tax return to the IRS (Internet Revenue Service).

So, what is needed to prepare a tax return? Skill development to learn how to use a tax software program. Think about the forms and paperwork you give to a tax preparer or accountant, and all they do is submit your information to a tax program to send your tax return to the IRS. It is that simple. Unless you have an out-of-the-ordinary situation, a small business owner, freelancer, or independent contractor, can learn to do their taxes.

My name is Michelle, and in 2019, I started to work for myself. I started working gig apps to earn money and studied how to prepare my tax return using AI (Artificial Intelligence) software programs. I decided it was time to become financially independent, and working gig apps like UberEats, DoorDash, and GrubHub allowed me to take a chance. I used the apps to earn money while reorganizing my life and developing new skills. It worked.

TurboTax is the AI software program I decided to learn. Learning how to use the TurboTax software is similar to learning a software program you use at a W2-job. However, instead, I learned the software program to help myself. With the help of TurboTax assistance and the help of artificial intelligence, I realized what to submit, what to do, and how to do it.

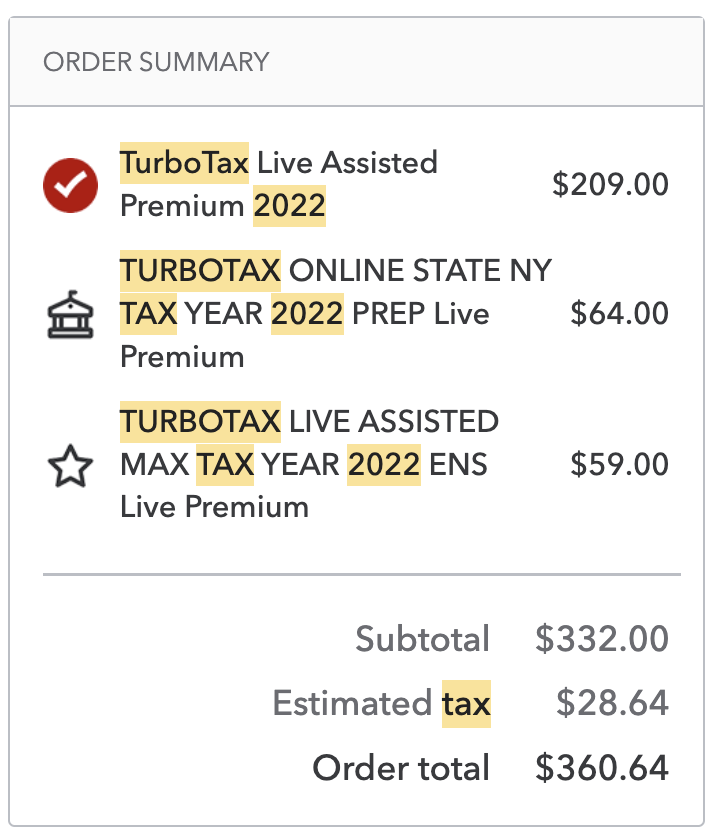

I pay to use the TurboTax software, and I choose to pay for the top-tier package. I do so because of all the benefits I have access to all year round and the protection it includes. For now, I feel this is the best choice for me. Grab a discount.

Click Here – https://turbo.tax/neefsm8t

Another perk to learning how to prepare your tax return is that you can write off the TurboTax fees as a deduction. At the time and date of writing this article, the entire cost of purchasing software can get deducted from the year it is used. Learning how to do your taxes teaches you to keep more of the money you earn by paying less income tax. The more financial education you have, the more you understand how to pay less to receive more.

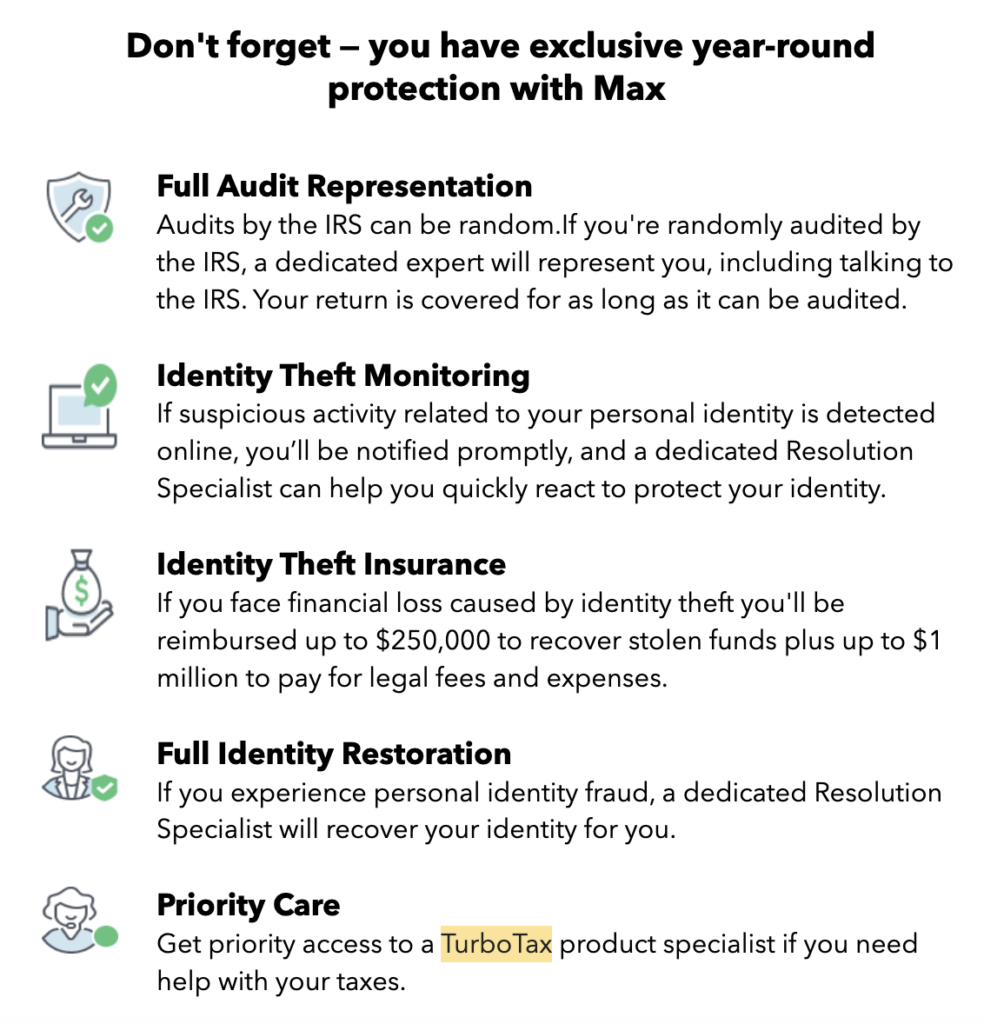

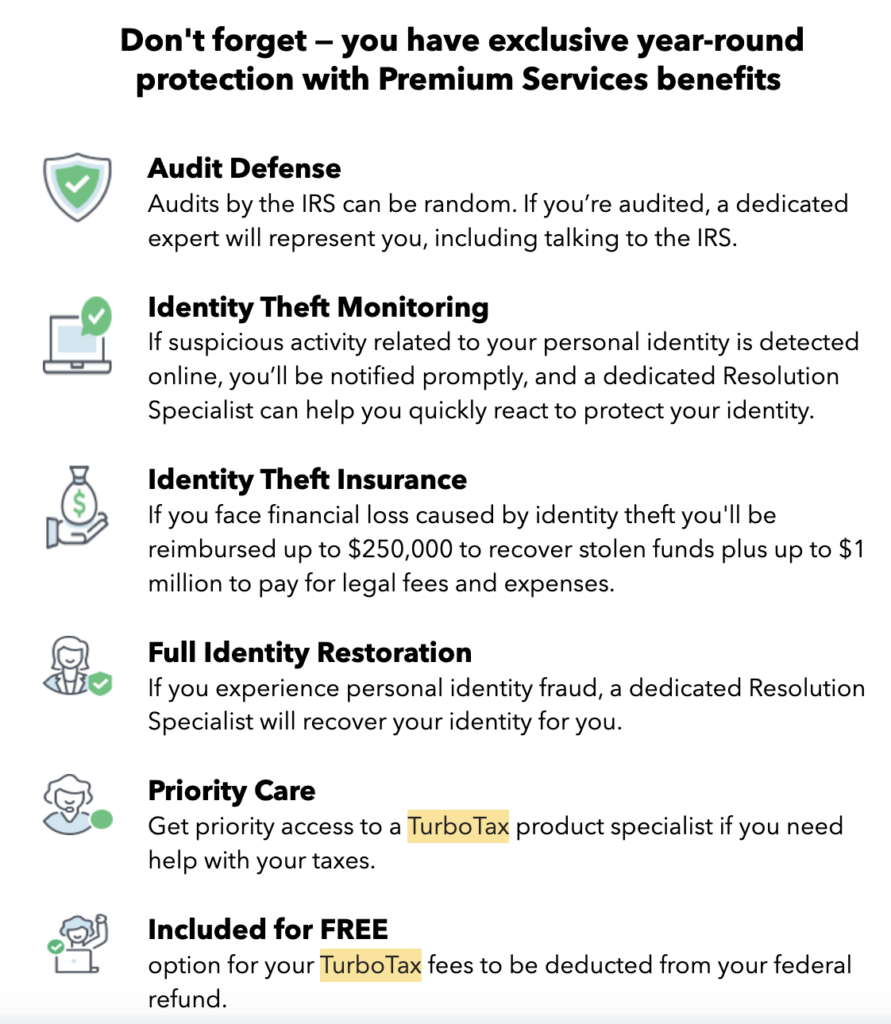

TurboTax full audit representation, audit defense, identity theft monitoring, identity theft insurance, full identity restoration, priority care, and the option to deduct TurboTax fees from your federal refund.

Thank you for visiting MyIncomeJob.com.